Transaction Violation Exceptions

Overview

Allowed Transaction Violations help merchants identify and manage payments that fall outside their configured transaction permissions without immediately blocking those payments.

Instead of rejecting certain payments at creation time, merchants can choose to treat unexpected or unapproved transaction types as a transaction violation event, allowing the payment to be created but flagged for review.

This provides greater operational flexibility while still maintaining control and visibility over transaction risk.

This feature allows users to:

Avoid unnecessary payment failures

Handle edge cases without reconfiguring merchant settings

Maintain strong auditability and review controls

Align allowed transaction handling with existing risk review workflows

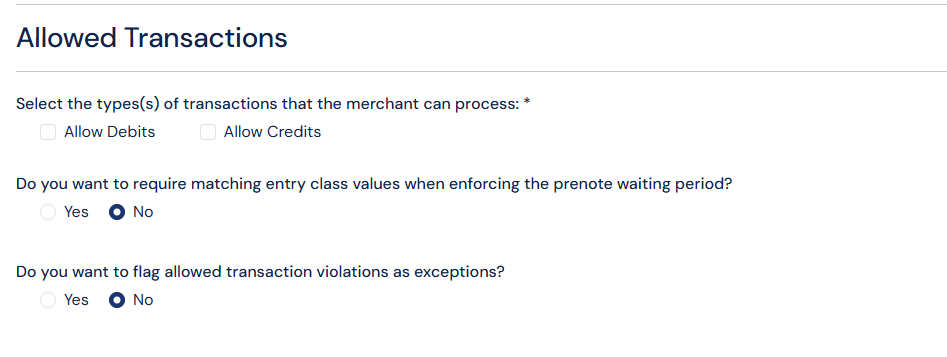

Merchant Configuration

Where to Configure

Merchants can configure this feature under:

Merchants → Payment Tab → Allowed Transactions

This area includes controls for:

Allowed debit transactions

Allowed credit transactions

Same Day ACH permissions

Entry class–related permissions

The Allowed Transaction Violation setting applies across this entire section.

Screenshot: Allowed transaction violations flag in Merchant

This setting that determines how the system handles transactions that do not match their allowed transaction configuration.

When enabled:

Payments that violate allowed transaction rules are not blocked

Instead, they are created and flagged for review

When disabled:

Payments that violate allowed transaction rules result in a validation error

The payment is not created

What Triggers an Allowed Transaction Violation

A violation occurs when a payment is created with characteristics that the merchant has not explicitly enabled, including:

Debit or credit transactions that are not allowed

Same Day ACH when Same Day ACH is disabled

Entry class combinations outside the merchant’s permissions

Payment Behavior When a Violation Occurs

Payment creation when the violation-handling setting is enabled:

The payment is successfully created

The payment does not fail validation

The payment is placed into a Pending status with Transaction Violation Exception as the Pending Reason

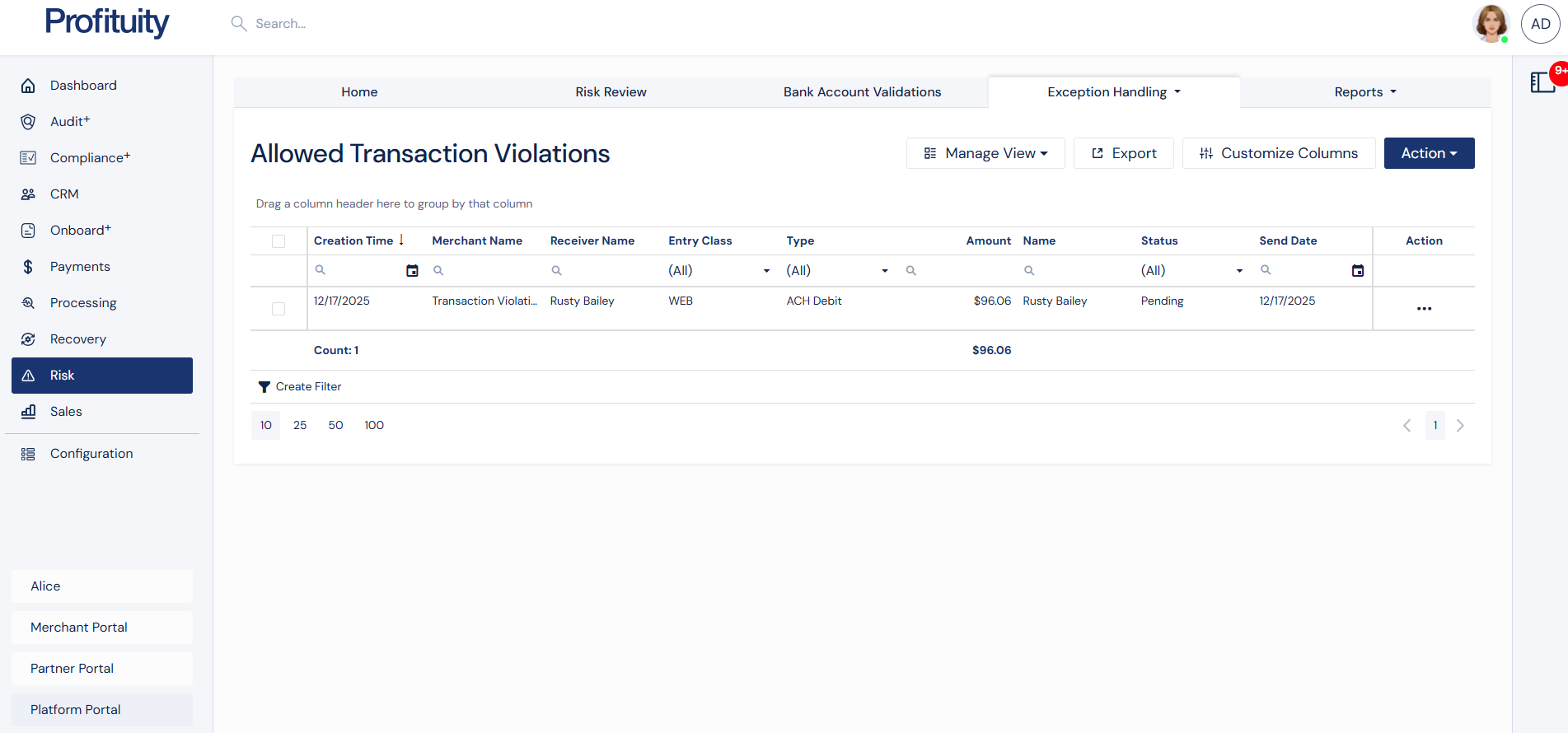

Allowed Transaction Violation Grid

Violation Review Page

Allowed Transaction Violations appear in a dedicated grid used for reviewing transaction violation exceptions.

The Allowed Transaction Violation section is located in Risk > Exception Handling.

From this grid, users can:

View affected payments

Take action on each payment

Bulk approve or reject payments

Screenshot: Allowed Transaction Violations Grid

Available Actions

For each violation, authorized users may:

Approve – Allows the payment to continue processing

Reject – Stops the payment from moving forward

Bulk Approve or Reject by selecting multiple payments at once

There is no automatic rejection; the decision is explicitly controlled by the user.

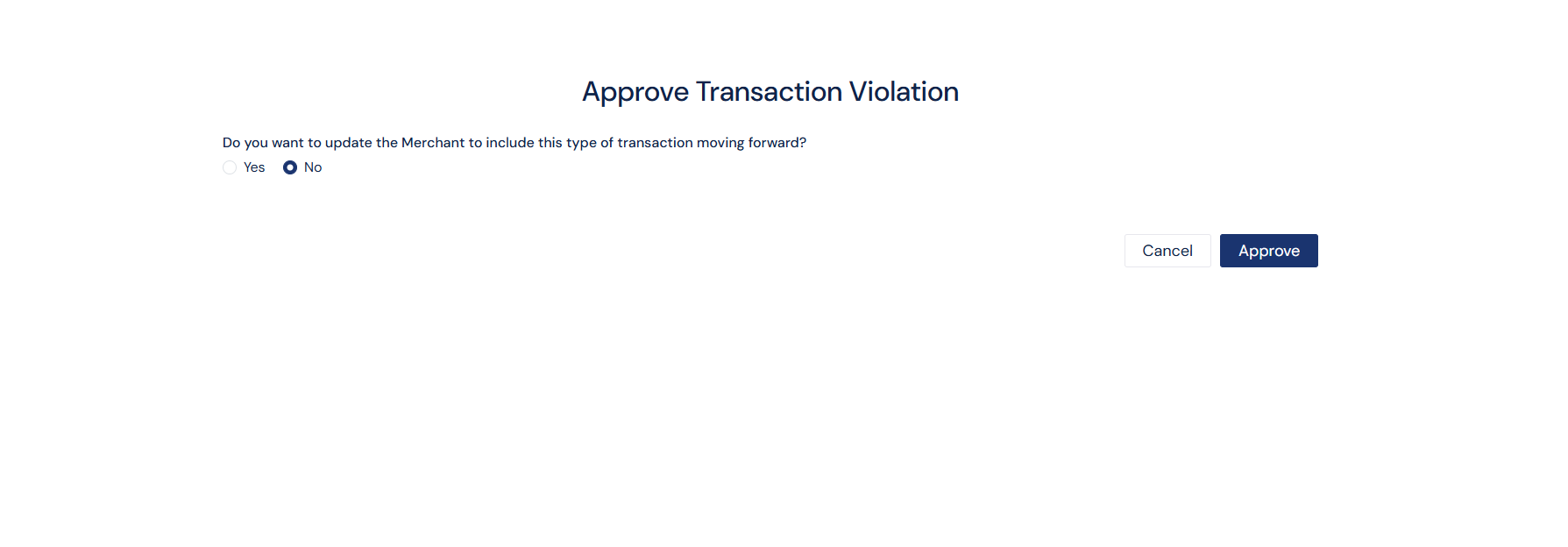

Approval Flow Behavior

When a violation is approved:

The payment resumes its normal processing lifecycle

The payment continues through all remaining risk and compliance checks

For example: OFAC, duplicate detection, and risk review

Approval does not bypass other safeguards

This ensures consistent enforcement across all risk controls.

Merchant Options

During the approval process, if the user has appropriate Merchant permissions, the user can opt to update the Merchant so the flagged transaction will always be allowed for the Merchant moving forward.

Screenshot: Approve Transaction Violation Modal

.png)